Table of Contents

ToggleIn the context of global trade and interconnected economies, the need for smooth cross-border payments has never been greater. As organizations expand their operations across borders, the demand for convenient payment solutions grows. In this blog post, we will discuss the significant change in API integration in allowing cross-border payments in 2024. Join us as we examine how businesses may use cutting-edge technology to expedite transactions and improve financial transparency while opening up new potential for development and expansion.

What is an API Integration?

APIs are a collection of rules and protocols that enable various software programs to communicate and exchange information. They serve as bridges between your system and external services like payment gateways, banks, and currency converters. APIs allow you to access the features and capabilities of these services without having to incorporate them into your system or code. For example, you may use an API to request a payment from a consumer, verify their identification, convert their currency, and send them a receipt from your own website.

How can API Integration enable cross-border payments?

APIs can help with cross-border payments by allowing you to connect with multiple payment options and providers while also managing the difficulties of currency translation, compliance, and security. For example, you may use an API to take payments from clients in many nations and currencies by connecting with common payment methods like credit cards, e-wallets, and bank transfers.

Furthermore, an API can let you convert currencies and exchange rates in real-time by connecting to a reputable currency converter provider. Furthermore, an API may help you comply with local and international standards like KYC (know your customer), AML (anti-money laundering), and PSD2 (payment services directive 2) by confirming your customers’ and transactions’ identities and eligibility.

What are the advantages of utilizing APIs for cross-border payments?

APIs for cross-border payments can provide several benefits, including saving time and money by eliminating manual processing and middlemen. It may also boost consumer happiness and loyalty by expanding payment alternatives, accelerating transactions, and improving the user experience. Furthermore, APIs may help you increase your market reach and development potential by providing access to new clients and locations. They can also increase your operational efficiency and flexibility by automating payment procedures and responding to changing client requirements.

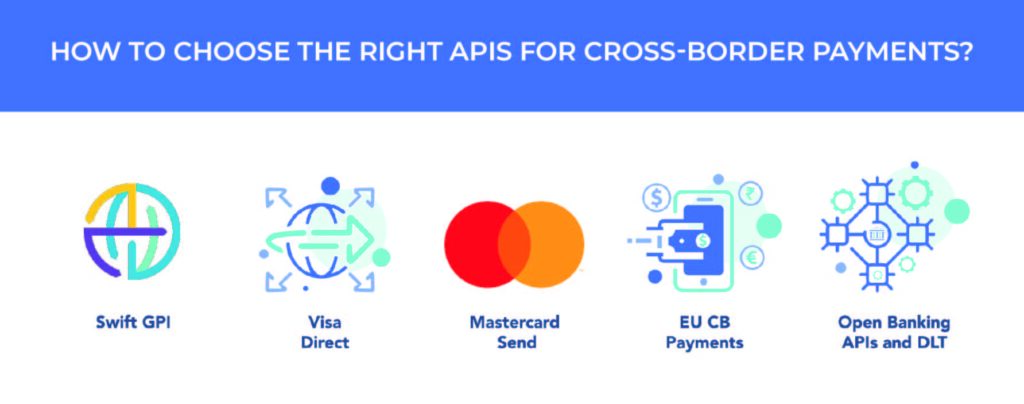

How can you choose the top APIs for cross-border payments?

When choosing the best APIs for cross-border payments, you should evaluate the payment methods and currencies you want to provide and accept, as well as the locations you want to reach. Furthermore, it is critical to consider the fees and charges connected with API use, as well as how they may effect your profitability and pricing strategy.

The APIs’ stability and performance, as well as how they manage mistakes, failures, and downtimes, should all be considered. Examine the APIs’ security and compliance to verify they safeguard your data and transactions while also adhering to applicable laws and regulations.

How do I integrate APIs for cross-border payments?

With the right technological expertise and experience, you can integrate APIs for cross-border payments. You should select an API provider that provides the capabilities and functionalities you want, review their documentation and recommendations, and test their API in a sandbox or demo environment. Once you’ve confirmed that the API fulfils your expectations and requirements, you may integrate it into your system using the code snippets and examples they give, or by utilising your own programming languages and tools. Finally, monitor and debug your API integration to address any difficulties or failures that may arise.

Conclusion:

As we reach the conclusion of our research on enabling cross-border payments through API integration in 2024, it is clear that the landscape of international transactions is experiencing significant change.

Businesses that use new APIs which may overcome the obstacles of traditional payment systems, streamline complicated operations, and realize the full potential of global trade. As we look ahead, API Solutions importance in facilitating frictionless cross-border payments will grow, allowing businesses to prosper in a more linked world.

Here are some ways to enable cross-border payments via API integration:

1 Choose an API provider that provides the required capabilities and services.

2 Read the documentation and recommendations.

3 Test their API in a sandbox or demonstration environment.

4 Register for an account with the payment API provider.

5 Choose a payment gateway that meets your company’s needs.

6 Create a merchant account.

7 Obtain API keys.

8 Integrate the payment gateway on your website.

9 Test the payment gateway.

Cross-border payment techniques may include:

✅ Transferring funds by wire

✅ Transactions using credit cards

✅Electronic money transfers.

✅ Money orders for international transactions

✅ Cryptocurrencies

✅ Request signing is a method of encryption in which you upload a public key to the Console and include a private key in the body of each request.

✅ An access_token that you produce and provide as a bearer token in each request.